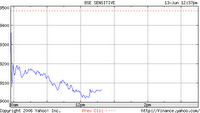

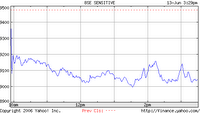

what the analysts said. Over at Lower Parel, TV Equity pundits wear glum faces, talk about how there is good value in the market and how the bears are back. Over in Delhi, journalists talk of a scam - blaming FII's and the policies of the government and one even tried to link up a scam between BCCL and the Sensex crash, thankfully her Ed-in-Chief spotted this in time and pulled the copy (Note, this lady was asked to move on from a pink BCCL paper). And our dear Finance Minister acquires yet another frown on his face. Hey, a few months ago, heck six weeks ago people were talking 15,000. Now we're looking at a sub 9,000 Sensex.

what the analysts said. Over at Lower Parel, TV Equity pundits wear glum faces, talk about how there is good value in the market and how the bears are back. Over in Delhi, journalists talk of a scam - blaming FII's and the policies of the government and one even tried to link up a scam between BCCL and the Sensex crash, thankfully her Ed-in-Chief spotted this in time and pulled the copy (Note, this lady was asked to move on from a pink BCCL paper). And our dear Finance Minister acquires yet another frown on his face. Hey, a few months ago, heck six weeks ago people were talking 15,000. Now we're looking at a sub 9,000 Sensex.Is the India story over? Naah. Not by a long shot. But what is going on in the equities markets? Honestly, they're just bouncing around a bit, like one of those crazy balls. Maybe, the Sensex has been inspired by the Teamgeist. All I can say is that the markets now are beyond comprehension - and I feel for those poor MBA students who are just taking up their jobs in the financial sector. Welcome to the real world baby!

Update 1 : At 1417 hours the market is back climbing again and is down only 338 points (only 338 points, I don't believe I said that!), however at around 1335 hours the market actually dipped below the 9,000 and touched its intra-day low of 8993.58. For a moment, please remember that this market has crossed 12,500 less than a month ago - before the crash on May 15 began a sequence of events that have led to the market shedding a quarter of its value. Ouch!

Update 1 : At 1417 hours the market is back climbing again and is down only 338 points (only 338 points, I don't believe I said that!), however at around 1335 hours the market actually dipped below the 9,000 and touched its intra-day low of 8993.58. For a moment, please remember that this market has crossed 12,500 less than a month ago - before the crash on May 15 began a sequence of events that have led to the market shedding a quarter of its value. Ouch!Update 2 : The markets have closed just above the 9,000 mark, after falling through for a few

seconds around 1335 the markets stayed above 9,000 for the rest of the day, but it still closed down over 400 points. It is a bit weird come to think of it, companies really haven't done so badly, and global markets are not on meltdown mood - everybody was bullish and went on a buying binge, think of this as one of those really intense Margarita parties. The only problem was that people were behaving like they were 19 and in college again, eventually you do have to throw up and feel awful. The head hurts for a bit and it does take a while to get back to normalcy. Fundamentals are strong - OK, so Chidu will still try and tax everything he can get his hands on, but other than that this market does look very well priced right now.

seconds around 1335 the markets stayed above 9,000 for the rest of the day, but it still closed down over 400 points. It is a bit weird come to think of it, companies really haven't done so badly, and global markets are not on meltdown mood - everybody was bullish and went on a buying binge, think of this as one of those really intense Margarita parties. The only problem was that people were behaving like they were 19 and in college again, eventually you do have to throw up and feel awful. The head hurts for a bit and it does take a while to get back to normalcy. Fundamentals are strong - OK, so Chidu will still try and tax everything he can get his hands on, but other than that this market does look very well priced right now.Thats it on the market, and I doubt it will fall below 9,000 for any sustained period of time. Invest wisely.

Also, on another note, nine years ago, I lost a friend (the guy used to travel in the same school bus as I did and was a tremendously smart and gifted individual, whose life was callously cut short) in a needless tragedy in a cinema hall in South Delhi (PDF). However, the man whose company was responsible for the building still cavorts freely and is darling of the Page 3 media in this country. Says a lot about us, doesn't it?

My main memory of that disaster was going to the Lodhi Road crematorium the next day, and being greeted by the most horrendous and awful sight of my life. Have you guys ever seen a mass funeral, particularly a mass Hindu funeral? It is a sight which I really don't care to remember, I feel sick thinking about it right now. I can remember breaking down over there - twelve pyres and the overwhelming stench of flesh. I've been paranoid about attending funerals ever since.

I also remember that the current Prime Minister of the country came there that day, yet because the man in question is a old-time Congressi, I doubt any thing will ever happen to him.

I will never forget Uphaar and the lives that were lost there.

13 comments:

Is Ansal a Congressi?

More Uphaar are waiting to happen at malls and multiplexes in Mumbai, which, on weekends, look like Dadar station. Poor exits can result into catastrophe. Very scary.

Every single old Delhi industrialist family is a Congressi, and Ansal is also one of them.

Shahshikant, I wouldn't be surprised if there was another disaster - but I don't think it will happen in newer buildings - at least inside - but because the access roads to the malls are so bad, fire-tenders might not get there on time and we might see a needless disaster. And it isn't just Mumbai, look at Gurgaon, Hyderabad, Chennai, Pune, Bangalore and even the smaller cities where fire safety norms are totally ignored (if they exist in the first place).

Not to forget Surendra Pratap Singh, arguably one of our finest Hindi TV journalists, whose absence has sent Hindi TV journalism into a tailspin from which it hasn't really recovered. I'm really sorry about the loss of your friend.

Hate to get all snooty at this point, but the Ansals an old Delhi business family? Bleh. The Ansals are as Johnny-come-latelys as the DLF guys. The truly old Delhi business family are the Sri Rams, and a very fine family they are.

now who'd this ex-BCCL lady be? Poo?

Indian market depends a lot on international money flow. I don't think Indian domestic purchases and corporate and other macro fundamentals are strong enough to counter the global liquidity trends. So those are very weak indicators at best.

There was a liquidity bubble in the global market driven by artificially low rates and excessive printing by US, EU and Japanese central banks. Bulk of that chased real estate, gold, other commodities and emerging markets for the last couple of years. That excess liquidity, mostly leverage driven, is being squeezed out rapidly. How long it continues depends on if US housing market and consumer spending slowdown triggers a shallow recession or a deep one and how strongly Fed deals with that scenario. At the bottom of that cycle, Indian equities will be a great buy, but timing the bottom will be very tricky. Keep an eye on dollar, US and Japanese interest rates and commodity market for an indicator.

Two days before the market crashed I informed SD/IndExp that the barman at the FreqFlyer lounge (IC/Kingfisher) at Delhi had told me that the market would crash, basis what he overheard from loose lips on the evening flights back out of Delhi.

She quoted me.

So here's this next nugget:- 6500 or so by Diwali, and then step in. Till then, look for distress sales in property if you have to invest.

Have you seen how air-fares on domestic flights have crashed again?

Now that's another story K . . .

They die every day.

In the Border.

They die every day.

In the streets.

If they don't.

We make sure.

They do.

In the theatres.

Or Pubs.

They cry in the BSE.

They cry in the NSE.

The Bear is drinking.

It's too hot.

What do you expect?

It's all about money.

Bear has left drinking.

It is after your honey.

So, working bees keep working.

And make the honey.

Bulls don't drink.

They screw.

How do you feel?

Bullish?

(I will use it in my blog too)

GBO: good thought on properties - it's impossible to touch anything in Mumbai ;(

GBO, thanks for your praise over the phone, pity you're not in Pune tomorrow we would have caught up.

T_M : The Shriram's are ancient Delhi industrialist royalty. The Ansals and KP Singh and family are however a lot older than many of 'newer' johnny come latelies dating back to the late 50's and 60's, though not with the class or pedigree of the Shrirams or Lal's (of Eicher). Both with close links to Loha Lady v1.0 and her younger son.

On the markets, US numbers don't look nice, the only good thing that might happen now is that oil prices might come down - are headed into a recession? Hmmm...

Anyway, first close below 9000 in several months today, even the papers are choosing to ignore the markets now! OK, not Mumbai Mirror, because they featured this blog today! But anyhoo.

I lost a friend too. They were all excited to see the show on the first day itself and went in a big group. Her mother and aunt, maasi and two cousins, family friend and her son, all died. It was a long time ago and I was young. So my memories are almost fading. But the case still goes on and achieves nothing.

congratulations on the Mumbai Mirror thingy ...

interesting post. people always overreact both ways.

Post a Comment